Speaking of Reformations...

From

Bond Economics, Oct. 29:

In The Reformation of Economics, Philip Pilkington argues that

societal structure determines the power of creditors and therefore

interest rates. He then attacks mainstream financial and economic

theories about interest rate formation. Although I agree that

institutions matter for the determination of the power of creditors, I

see mainstream theories of interest rate formation as adequate within

the current institutional structure of developed countries. (Link to my review of The Reformation in Economics.)

My Summary of Pilkington's Arguments

This article is based on some of the contents of Chapter 9 of the book

-- Finance and Investment. As an initial disclaimer, I want to emphasise

that I am going to summarise some of the points that Philip Pilkington

makes there, but I am not attempting to discuss the entirety of his

arguments.

He is highly dismissive of mainstream economics and finance, and the use

of the Efficient Markets Hypothesis with respect to interest rate

formation. I agree with some of his criticisms, but I rely upon the

efficient market hypothesis in my analysis of interest rate

determination (rate expectations theory). The divergence in views can be

viewed as the result of looking at different questions.

Firstly, the discussion of interest rates in classical economic theory

is utterly worthless. My disagreement with Pilkington on that score is

that I think the entire topic should be ignored as an intellectual

embarrassment, whereas he argues that "Wicksell is no relic" (page 253).

I come from an academic background where we do waste time on dead

theories; for example, I could find no mention of optimal control in a

quick scan of the standard robust control theory textbook Feedback Control Theory, by

Doyle, Francis, and Tannenbaum. This is despite the fact that there is

an obvious mathematical linkage between optimal and robust control. (The

Kalman Filter is one of the few relics left behind from optimal control

theory.) As an ex-academic, I understand the concerns regarding

originality, but at the same time, we cannot cripple our ability to

advance economic theory by wasting time worrying what Wicksell -- or

Keynes -- really meant.

Modern financial theory argues that we can decompose the interest rate

of any instrument into three components (assuming there is no embedded

optionality, such as the ability to prepay, convert, call, or put the

instrument back to the issuer):

- The expected "average" of the short-term credit risk-free rate

(usually the policy rate) over the maturity of the instrument.

(Technically, a geometric average.)

- The term premium for credit risk-free instruments (e.g., Treasury

bonds in the United States) associated with the term of the instrument.

- A credit spread.

(If you want to get finicky, there are second-order effects, such as the

effect of being able to fund a bond cheap at a special repo rate, as

well as benchmark or liquidity premia. The liquidity premium is a

particularly confusing concept in this context, as Philip Pilkington

prefers Keynes' liquidity preference theory. His concept of a liquidity

premium is what I would call the term premium; the liquidity premium

under my definition is how much more expensive a benchmark bond is

relative to a fitted curve.)

In my view, modern mainstream models (i.e., Dynamic Stochastic General

Equilibrium) are largely consistent with this version of financial

theory, although they contain other elements that are the source of

problems (the embedded assumption how interest rates affect economic

dynamics).

Conversely, Philip Pilkington argues that borrower's interest rates are determined by two factors.

- Institutional structure of the economy.

- Liquidity preferences of investors.

I will discuss these in turn.

Institutional Factors

The modern financial theory decomposition of interest rates makes sense

in the modern institutional context, where we have large dedicated fixed

income investors and a well-defined bond market. It would probably be

of little use in analysing lending in ancient Rome.

Pilkington argues that interest rates depend upon the power of

creditors. This is arguably true; we no longer have debt slavery or

debtors' prisons (although some political groups seem to be sneaking

debtors' prisons back under the door). Therefore, I have no argument

that the "total cost" of borrowing (when we take into account the risk

of being thrown into prison) depends upon institutional factors.

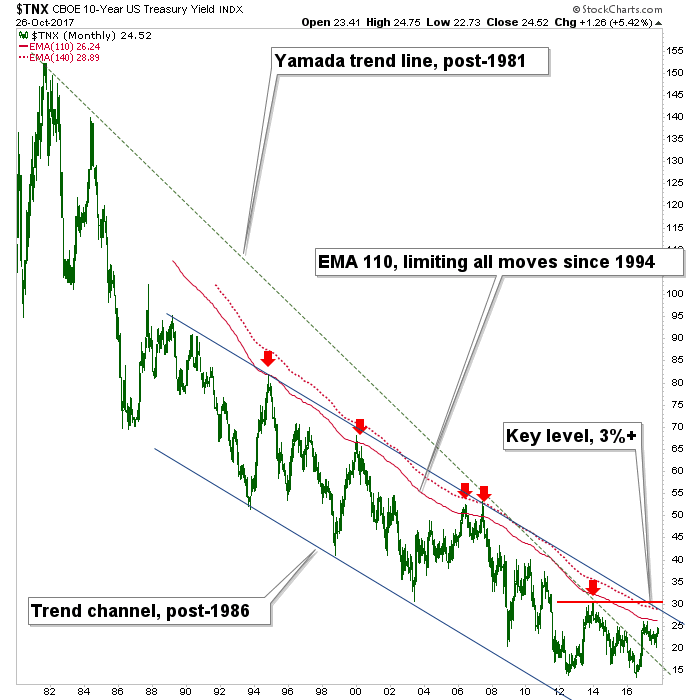

However, does this have much to say about market interest rates in the

developed economies over the past few decades? It is very hard to see

trajectory of interest rates from the post-war lows, to the early 1980s

peak, and back to the current lows as being the result of changes to the

power of creditors as a class.

He raises the question of loan sharks....

MORE

![Photo of Rep. Frederica Wilson [D-FL24]](https://www.govtrack.us/data/photos/412412-200px.jpeg)