From FT Alphaville:

Early estimates of Harvey’s economic impact

The awful devastation in Southeast Texas continued on Monday, with rains expected to continue well into the week.

If FT Alphaville readers want to help, we recommend donations to a local organisation such as those listed in this thread by Jia Tolentino. (FT Alphaville’s choice was the Texas Diaper Bank, which has been creating relief kits for displaced families.) The mayor of Houston has also started the Hurricane Harvey Relief Fund.

Given that the rains have not yet ended, these first estimates of Harvey’s potential macroeconomic impact should be accepted cautiously. We’ll be paying attention throughout the week for meaningful updates. In no particular order:

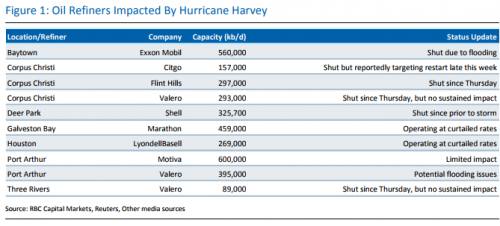

1) From the RBC commodity strategy team, a look at the potential effect on the oil market (our bolding throughout):

The impact of a storm of such magnitude and trajectory is fluid and has wide ranging implications for the oil market. While several regional refineries have reported no substantial damage from the storm, assessments of oil refineries and infrastructure are ongoing and the impact of the storm could be felt long after its passing in the event of extensive damage.At initial glance, the development is bearish for crude oil from a demand perspective given that some 2 mb/d of refining capacity remains shut. This has, tangentially, also spurred a knee jerk price spike higher for refined products. Prompt month gasoline cracks have surged 25% since last Wednesday’s close en route to multi-year highs. The Texan Gulf Coast comprises nearly 27% of total US refining capacity. Further details surrounding the status of localized refineries will dictate the extent and tenor to which refined product prices remain elevated.

US Production Impact

While pockets of the Eagle Ford and US offshore production has been curtailed or suspended for preventative measures, hurricanes are not as bullish from a supply disruption standpoint as in years past. A decade ago, prior to the US shale revolution, the Gulf of Mexico made up a larger percentage of total US oil production (closer to 30% vs current levels near 15%). Simply put, there are fewer barrels at risk from an aggregate percentage of US production. In fact, many US offshore Gulf of Mexico barrels have been exported to Asia this year. While it is premature to rule out damage to elements impacting production, a growing source of US crude imports have come from Canada rather than waterborne routes.

And additional thoughts from RBC on the implications for global supply chains....MUCH MORE