...Regarding a short on KMI, I hate paying dividends on short positions.The stock was at $41.00 at the time.

Hate it, hate it, hate it.

But I might be tempted in this case. And the rate of ascent on the stock is definitely rolling over....

It went to $11.20 this January, so sometimes having to pay the divi works out.

From Bloomberg:

The world’s top performing hedge fund is shorting companies that are juicing their valuations by promising investors big dividends.

AAM Absolute Return Fund, which according to HSBC Holdings was the world’s best performing hedge fund in 2015, is betting on declines for energy companies that “even short term will struggle to uphold dividends,” according to Harald James-Otterhaug, who oversees the fund as the chief executive officer at Oslo Asset Management AS.

“In times of low rates when investors chase yield, we’ve seen that companies that pay dividends have often been rewarded with generous valuations,” the 43-year-old said in an interview Monday at his attic loft office overlooking Oslo’s Royal Palace. “Some stocks have ended up being very overvalued.”

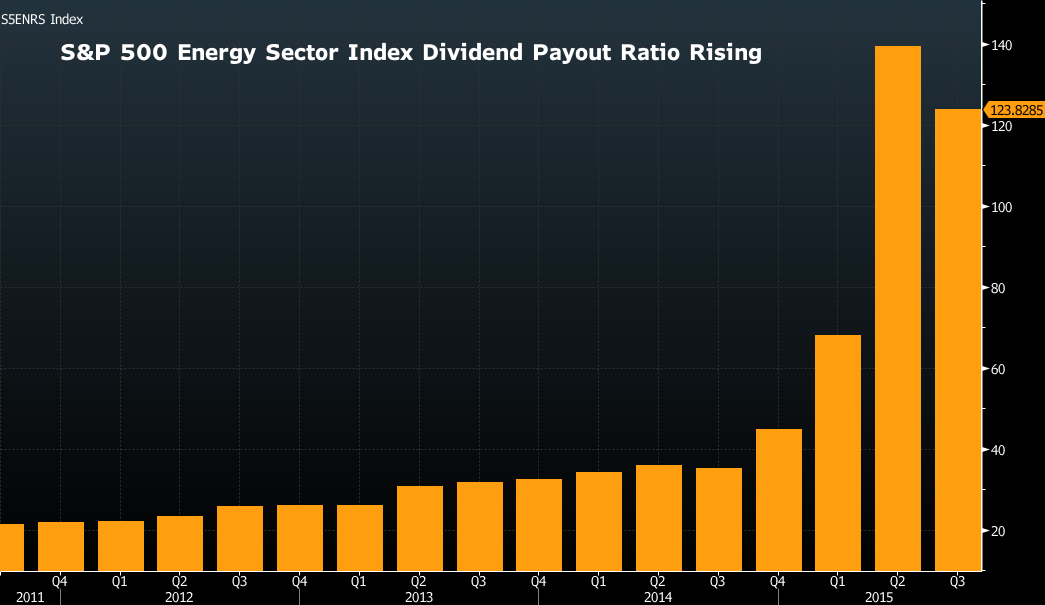

The world’s oil majors have been borrowing more to keep up with dividend payments amid slumping profits. The debt of Exxon Mobil Corp., Royal Dutch Shell Plc and other oil giants has swelled to a combined $138 billion and is likely to increase in the third and fourth quarters. In Norway, state-controlled Statoil ASA, added $5.3 billion in debt in the year ending June 30.

James-Otterhaug’s $230 million fund, which focuses on long and short bets in energy and natural resource stocks, returned 58.5 percent in 2015. It reaped the benefits of shorting stocks, particularly in energy infrastructure, after sticking it out in 2014 as its net asset value shrank amid client withdrawals and a 9.8 percent loss.

“Patience is the most difficult,” he said. “It’s frustrating when you can present a case that with high probability can give high return -- 50 to 100 percent -- in three to five years. We will always be early because we’re value oriented.”

The fund, which uses fundamental analysis to pick stocks that it views as over or undervalued, seeks to avoid correlation with any asset class. That strategy has seen it return a net 12 percent a year since starting at the end of 2005. It has returned 10.2 percent so far this year through July.

While the fund has kept its short bets after two years with crude under $100, James-Otterhaug now sees “very good opportunities going long for the first time in a long time” in the cyclical energy sector. He started the fund after working within Norwegian billionaire Kjell Inge Roekke’s Aker Group....MORE