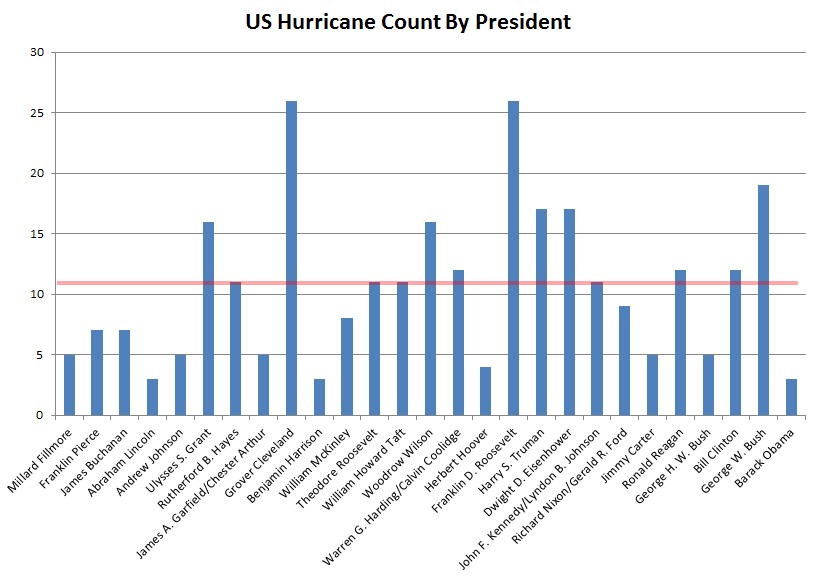

"...this was the moment when the rise of the oceans began to slow and our planet began to heal..."

There's a reason the State of Florida just offloaded $1.5 Billion worth of self-insured risk.

From Bloomberg:

Bond buyers are betting more than ever on the mercy of Mother Nature as they seek to boost yields being suppressed by central banks.

Demand for notes linked to insurance against hurricanes and other natural disasters is prompting investors to accept the lowest relative yields in almost a decade for this time of the year, when the Atlantic storm season gets underway. Buyers are speculating that the $22 billion market can continue its streak without an annual loss even as Warren Buffett said last week that Berkshire Hathaway Inc. is avoiding writing hurricane insurance in Florida because premiums have been pushed too low.

Investors who have snapped up $5.76 billion of new catastrophe bonds this year, the fastest pace of issuance ever as measured by data provider Artemis, are being emboldened by weather forecasts and average annual returns of 8.5 percent since 2002. Offerings this year include a record $1.5 billion transaction linked to potential hurricane damage in Florida.

“Wind season looks to be slightly below average in terms of the hurricane outlook and that’s attractive,” John Brynjolfsson, chief investment officer at Irvine, California-based hedge fund Armored Wolf LLC, which oversees about $700 million including the disaster-linked notes, referred to as cat bonds. “Although cat bonds are relatively tight, on a comparative basis they look attractive to capital markets investors.”

Spreads Narrow

Cat bond yields have dropped to about 4.7 percentage points more than benchmark interest rates, the lowest second-quarter level since 2005 and down from 6.57 percentage points a year ago, according to John Seo, managing principal at Fermat Capital Management LLC. The Westport, Connecticut-based firm oversees $4.5 billion, more than 90 percent of which is invested in cat bonds.

“The hurricane does not know the rate that was charged for the hurricane policy, so it’s not going to respond to how much you charge,” Buffett said at the Edison Electric Institute’s annual convention in Las Vegas on June 9. “And if you charge an inadequate premium, you will get creamed over time.”...MORE